Research and publish the best content.

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

Already have an account: Login

Your new post is loading... Your new post is loading...

|

Curated by jean lievens

Economist, specialized in political economy and peer-to-peer dynamics; core member of the P2P Foundation

Other Topics

Anders en beter

Met P2P voorbij markt en staat: voor een progressieve coalitie rond de commons. Met nieuws over op p2p gebaseerde praktijken en hoe de overheid, de politiek en de zakenwereld ermee (kunnen) omgaan...

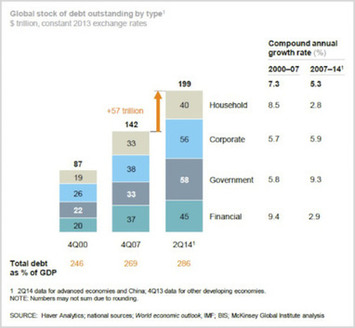

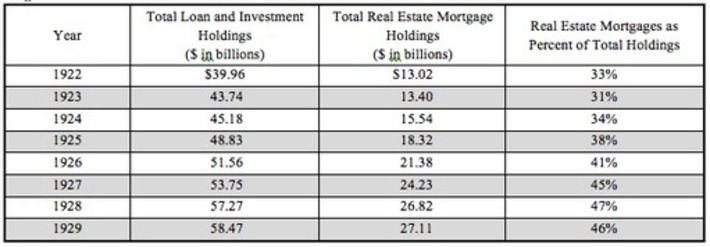

money money money

on money and what it is

music-all

From the Great White Way to the West-End and beyond

Peer2Politics

on peer-to-peer dynamics in politics, the economy and organizations

real utopias

Not TINA (There Is No Alternative) but TAPAS: THERE ARE PLENTY OF ALTERNATIVES

|